Low levels of access to electricity is what defines underdevelopment and national poverty. This has for too long been the case in Africa. But now, thanks in part to the continent’s resources boom, the problem is being addressed. Crucially, it is happening in so many places and in so many ways that the continent’s energy infrastructure is at last acquiring genuine depth.

Part of this is reflected by the great international interest, including that of the private sector. Perhaps the most important landmark here was US President Barack Obama’s June 2013 Power Africa initiative, managed by the US Overseas Private Investment Corporation (OPIC).

This commits US$7 billion to energy infrastructure support in Africa over five years, including substantial components for ‘technical assistance’ – in other words grant monies for planning and technical studies. Most of the Power Africa funding (US$5 billion) will be used to leverage private investment through export and credit guarantees administered by the US Import Export Bank.

What is really encouraging thing about the new generation of electricity projects across the continent is the sheer range of power sources being tapped. From massive hydroelectric plants on the Nile (Ethiopia’s Hidase dam), the DRC (Inga 3), new gas-fired plants in Ghana, Tanzania and Mozambique, to renewables being tapped in Kenya (wind, solar and geothermal), South Africa (wind and solar), Nigeria (solar) and Ghana (solar), the drive is on to electrify the continent.

Africa’s energy deficit easily lends itself to dramatic illustrations. In a July 2014 press release, OPIC referred to the fact that 600 million people in sub-Saharan Africa have no access to electricity. More than half the continent’s population is heavily dependent on biomass – wood, charcoal and waste – for heating, cooking and lighting, supplemented by paraffin, which is both costly to households and dangerous to use. OPIC points out that the population without access to electricity in Africa is equivalent to the entire populations of the US, the UK, Australia, Japan and France. Africa’s power backlog, it suggests, will cost US$300 billion to address.

The most important landmark was US President Obama’s June 2013 Power Africa initiative

There are dangers in reducing the problem to a matter of generation cost or simple household poverty, for the essence of the solution is a matter of increasing demand, especially industrial demand. Consumer-led programmes have been tried before. In South Africa, in the early 1990s – a time when generation capacity was taken for granted – the national electricity parastatal Eskom actually gave away electrical appliances, electrical stoves in particular, in an effort to boost household consumption.

The theory is that subsistence households need to be boosted onto an ‘energy ladder’. The use of electrical goods would free-up household resources, which would boost incomes and create a virtuous developmental cycle involving ever-increasing electricity consumption. But in Eskom’s case, the ‘decisive break’ with reliance on biofuels never happened. While there was incremental electricity take-up in some cases, households generally continued to use biofuels and paraffin preferring, it seems, the flexibility of a multi-pronged survival strategy. Even at subsidised rates, poor households preferred to put their scarce resources to other uses.

Since 2000, the South African government has overcome resistance by offering ‘free’ basic electricity – power supplied to poor households was paid for by industrial, commercial and middle-class consumers. This is not an option in most African countries where these categories of users are themselves underdeveloped.

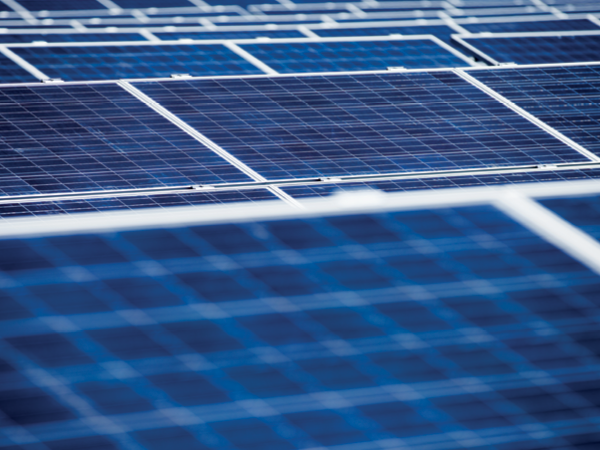

Current literature on the potential use of small-scale renewable energy to reduce Africa’s backlog may well be informed by similar unrealistic expectations. In 2010, the Economist argued that ‘bottom-up’ energy solutions, involving technologies such as solar panels and other micro-solar solutions, offered ‘an opportunity to leapfrog the centralised model (of national on-grid provision) … just as the developing world has leap-frogged fixed line telecommunications and gone straight to mobile phones’.

On the surface, this may seem like an attractive argument. It has to be pointed out, however, that the beneficiaries in the glowing case studies (published by implementing NGOs) number in the tens perhaps hundreds, while the non-electrified population totals hundreds of millions. Unlike cellular telephony – which is profit-driven – local communities cannot realistically be expected to continue to carry the costs (of maintenance for instance) once the donor subsidy has expired?

There is no doubt a role for ‘bottom-up’ renewables initiatives in Africa but it seems unrealistic to think that this is a new paradigm that will displace large-scale on-grid solutions. Some of these, of course, involve renewables.

In Kenya, for instance, geothermal energy comprises a third of the 2014 National Energy Policy. Geothermal energy is power generated by the heat of the Earth. It is available along the rifts where the planet’s tectonic plates collide, is entirely clean (in the carbon-free sense) and uses proven technology.

Kenya already generates one-fifth of its electricity from the four thermal plants at Olkaria, north-west of Nairobi. Expansion plans are in implementation with a 400 MW plant at Menengai that is due to come on-stream in 2016.

These initiatives will take Africa beyond minerals extraction and into the next phase of growth

Driven partly by Kenya’s example, other countries along the East African rift are exploring the same source. Tanzania, Ethiopia and Uganda already have licensed exploration companies. The grand-daddy of all traditional renewable energy sources is, of course, hydroelectrical. But hydro has been unpopular in recent years, owing to the environmental and social damage done when huge areas are deluged. The massive Chinese Three Gorges project was at the centre of this with each successive global media report – detailing communities displaced, rare wildlife and habitats threatened and archaeological rarities swept away – reinforcing the negativity.

On top of this came the 2000 Report of the World Commission on Dams, chaired by the then South African Minister of Water Affairs, Kadar Asmal. The commission emphasised the negative trade-offs that come with dam-building, and presented process recommendations that can only be described as inhibiting.

However, some of the large hydro possibilities in Africa are extremely promising. In the DRC, the Congo river’s Inga Falls site has been mooted as the means to transform Central and Southern Africa. The first two phases – of an anticipated five – were bedevilled by political instability. But the DRC looks more stable and, in March this year, a consortium of the World Bank and African Development Bank committed to grant finance of US$106 million to fund technical studies for the third phase.

Large industrial customers and a transborder trans-mission net are the keys to unlocking the potential of the Congo river. The World Bank says that under the present plan, South Africa can be expected to buy 2 500 MW, more than half of Inga 3’s potential capacity, while most of the rest will supply the DRC’s copper-rich Katanga province. At present Katanga has to import about half its electricity from neighbouring Zambia.

Another massive hydro project currently underway is Ethiopia’s Hidase (or Millennium) dam on the Blue Nile. Set to produce the first electricity in 2015, the dam has been in gestation for 50 years – the first feasibility studies were completed in 1964. The 6 000 MW project will position Ethiopia to be an electricity exporter in East Africa.

Africa’s exponentially expanding oil and gas sector is starting to bridge the supply and demand sides of the electricity equation. In July this year, Mozambique Energy Minister Salvador Namburete announced that the country’s demand for electricity was growing at 15% per year, requiring an extra 100 MW of generating capacity annually – and this is only the current electricity deficit. The World Bank forecasts a growth rate for Mozambique of 7% per year, which will require even more power. Fortunately Mozambique’s gas industry – a primary driver of surging demand – also offers the solution.

Mozambique has a number of gas-fired plants under construction and due to come on stream in the very near future. A government-owned 140 MW plant at Ressano Garcia began operating in mid-2012 and a second, of similar size, constructed in partnership with South African company Sasol is due to start up this year. The Ressano Garcia site is attractive in that it is located on the establi-shed pipeline connecting Mozambique’s Pande gas field to Sasolburg in South Africa – perfect for selling electricity into South Africa’s huge yet underpowered grid.

Gas-fuelled power stations are typically small and can be constructed rapidly. They are springing up in Ghana and Tanzania. The Kinyerezi power station outside Dar es Salaam will nearly double Tanzania’s generation capacity by 2015.

The sheer scale of energy infrastructure activity in Africa in 2014 defies simple description. It is a bubbling mass of initiatives that are already in the process of coming on-stream. A continent-wide series of linked grids is no longer a pipe dream. More importantly, these are the initiatives that will take Africa beyond minerals extraction and into the next phase of growth.